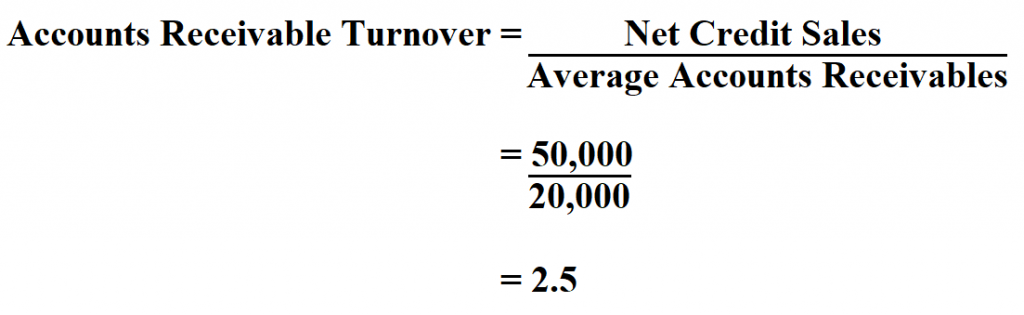

That’s why in some cases, the net sales figure is used instead of net credit sales. Unless a company’s accounting policy, practice, or system separately accounts for credit sales, more often than not, only the total sales will be accounted for (whether it’d cash sales or credit sales). While the beginning and ending balances of a business can readily be found on its balance sheet, the data on credit sales isn’t always available. Gathering the data required for the computation of the receivable turnover ratio is probably the hardest part of it. If there are significant fluctuations between the beginning and ending balances, the weighted average can be used instead. It can be computed by adding the sum of the aforementioned balances and dividing the resulting figure by two. If possible, identify the sales discounts, returns, allowances that are attributable to credit salesĪverage Accounts Receivable – refers to the average of the beginning and ending balances of accounts receivable. It can be computed by subtracting the sales discounts, returns, and allowances from the gross credit sales. Net Credit Sales – refer to sales on credit or sales where cash payment is collected within a certain period. Receivable Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable You only need to divide the net credit sales by the average accounts receivable.

#YETA ACCOUNT RECEIVABLE TURNOVER RATIO. HOW TO#

How to compute Receivable Turnover RatioĬomputing a business’s receivable turnover ratio is pretty straightforward once you have the required data. With the receivable turnover ratio, we can get a quantitative measure of a company’s ability to collect its accounts receivable. If a company has a high collection rate, then it follows that it will have great liquidity. This is why some businesses report high sales figures yet still face liquidity issues.Ĭredit management (or management of accounts receivable) and liquidity go hand in hand. Less importance is given to the collection of accounts receivable. In an income statement, what is often shown are the sales, be it cash sales or credit sales, and other income items. Top management often gives more importance to sales and profit margins, and it shows. So they’re worse than actual loans, but the exchange is that there are more sales.Īccounts receivable often have terms of 30 or 60 days, though there are some businesses within certain industries that can extend the term to even more than a year. In essence, accounts receivable are loans extended to customers – except that they receive products instead of cash, and that there’s no interest. This ratio can be computed on a monthly, quarterly, or yearly basis. It gives us an idea of how effective and efficient the business is in collecting its receivables. It is also known as the Debtor’s Turnover Ratio or the Accounts Receivable Turnover Ratio. One of the efficiency ratios, the Receivable Turnover Ratio is a metric that measures how often a business’s accounts receivable is collected (on average) over a given period. It can also help your business in managing your business’s credit effectively. With proper knowledge about how it works, you can design or improve your current policies and practices to ensure that your business collects payments on time. In this article, we will learn about the Receivable Turnover Ratio, what it tells you about your business, and how to compute for it. One such ratio is the Receivable Turnover Ratio. Having strong credit and collection policies help a business in dealing with its credit sales and the corresponding accounts receivable.Īlso, there are many tools that can help a business in managing its accounts receivable such as financial ratios. This will certainly affect the business’s liquidity.Īnother, there is the risk of not being able to collect any cash on the sale at all.īusinesses must do what they can to avoid such a thing from happening. One, when a business makes a credit sale, it won’t be receiving cash at the time of sale but rather at a later time. There are concerns when it comes to credit sales though. This increases the potential customer base that the businesses can reach. Oftentimes, businesses offer sales on credit in an effort to increase their total sales.īy offering sales on credit, businesses can accommodate customers who don’t always have cash readily available on hand. One of the processes that you can improve upon when it comes to your business is the process of how it deals with credit extended to customers – a.k.a accounts receivable.Īccounts receivable is linked with credit sales or sales on credit.

It shows promise to your stakeholders that you care about your business enough to have it evolve as it continues to operate. Continuous improvement of your business and its processes is essential for its continued existence and eventual success.

0 kommentar(er)

0 kommentar(er)